reverse sales tax calculator quebec

OP with sales tax OP tax rate in decimal form 1. Read reviews compare customer ratings see screenshots and learn more about Quebec Sales Tax Calculator.

Reverse Tax Calculator Quebec 2022

In Quebec the provincial sales tax is known as Quebec sales tax.

. Ensure that the Find Invoice Total tab is selected. Accurately calculates GST PST QST andor HST for any province or territory. Clean attractive and easy to use interface.

For the TPSTVQ dividing 100 by their combined 14975 percent gives a result of 6678. Calculate the total income taxes of a Quebec residents for 2021. For provinces that split GST from PST such as Manitoba British Columbia Quebec and Saskatchewan a No PST checkbox will appear.

Its great to have a reverse GST QST calculator because it will save you a lot of time when youre trying to figure out how much taxes you have spent on your purchase. Reverse sales tax calculation. This is the after-tax amount.

In Quebec merchants have to pay GST and QST for all the sales madeCalculate you sales tax. Province of Sale Select the province where the product buyer is located. Here is how the total is calculated before sales tax.

Subtract that from the receipts to get your non-tax sales revenue. Reverse Québec Sales Tax Calculator Online. Instead of using the reverse sales tax calculator you can compute this manually.

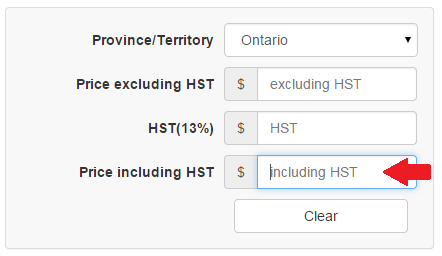

In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. Following is the reverse sales tax formula on how to calculate reverse tax. GSTQST Calculator Before Tax Amount.

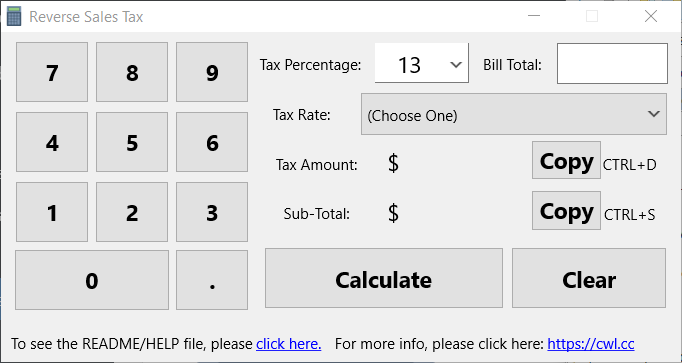

Also a handy tool for business owners sales reps accountants and anyone else who needs to find the before or after tax amount. 13 rows Current HST GST and PST rates table of 2022. Great for finding your total cost before a purchase.

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Reverse GSTQST Calculator After Tax Amount. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC.

Reverse Sales Tax Formula. Formula for calculating reverse GST and PST in BC. Simply dictate the before or after tax amount and then instantly see the results.

Calculate GST with this simple and quick Canadian GST calculator. Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. To do that youd divide the tax rate by 100 and add 1 then divide your selling price by that number.

06 r6 100sum p5q5 p6 o6p5. Great for finding your total cost before a purchase. Amount without sales tax QST rate QST amount.

Choose which one you are using in the drop-down. Amount with sales tax 1 HST rate100 Amount without sales tax. Enter the final price or amount.

British Columbia Manitoba Québec and SaskatchewanIn Québec it is called QST Québec Sales Tax and in Manitoba it is RST Retail Sales Tax. Formula for reverse calculating HST in Ontario. Reverse Sales Tax Calculator Online.

Who the supply is made to to learn about who may not pay the GSTHST. GST and QST 2020. GST and QST 2020.

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Clean attractive and easy to use interface. In New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island it is part of HST Harmonized Sales Tax.

The following table provides the GST and HST provincial rates since July 1 2010. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013. Type of supply learn about what supplies are taxable or not.

Download Quebec Sales Tax Calculator and enjoy it. Click to select it if the seller is in a different. This means youll occasionally have to account for the taxes youve incurred for a purchase by backing out the 9975 percent TVQ and the 5 percent TPS.

The companion Apple Watch app makes finding the sales tax even easier than before. The Quebec Sales Tax QST is simply the sales tax applied in. For example suppose your sales receipts are 1100 and the tax is 10 percent.

Why A Reverse Sales Tax Calculator is Useful. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. There are times when you may want to find out the original price of the items youve purchased before tax.

Clean attractive and easy to use interface. Now you divide the items post-tax price by the decimal. Amount without sales taxes x.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850. The rate you will charge depends on different factors see.

Reverse GSTQST Calculator After Tax Amount. Where the supply is made learn about the place of supply rules. Montant sans taxes Taux TPS Montant de la TPS.

Sales tax amount or rate. How are dividends taxed in Canada. Tax Me is accurate easy to use and helps you quickly calculate Canadian sales tax for any province or territory.

Calculates the canada reverse sales taxes HST GST and PST. Voici la façon dont est calculé le montant avant taxe. Divide your sales receipts by 1 plus the sales tax percentage.

On March 23 2017 the Saskatchewan PST as raised from. Divide 1100 by 11 and you get 1000. Montant avec taxes Montant TPS et TVQ combiné 114975 Montant sans taxes.

Only four Canadian provinces have PST Provincial Sales Tax. Tax Me is accurate easy to use and helps you quickly calculate Canadian sales tax for any province or territory. Multiply the result by the tax rate and you get the total sales-tax dollars.

13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is. You will need to input the following. Montant sans taxes Taux TVQ Montant de la TVQ.

Amount without sales tax GST rate GST amount. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

To find the original price of an item you need this formula. Also a handy tool for business owners sales reps accountants and anyone else who needs to find the before or after tax amount. Amount without sales tax x.

To calculate the total amount and sales taxes from a subtotal. Reverse Québec Sales Tax Calculator Online.

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

How To Calculate The Taxes Gst Pst And The Final Price Youtube

Reverse Hst Calculator Hstcalculator Ca

Pst Calculator Calculatorscanada Ca

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

V A T Calculator Pro Tax Me By Tardent Apps Inc

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

![]()

Quebec Sales Tax Calculator On The App Store

Quebec Sales Tax Calculator On The App Store

Canada Sales Tax Calculator By Tardent Apps Inc

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

How To Calculate Sales Tax In Excel Tutorial Youtube

Canada Sales Tax Gst Hst Calculator Wowa Ca

Canada Sales Tax Calculator On The App Store

Canada Sales Tax Calculator On The App Store